28 Mayo 2024, Martes

Happy 48th Anniversary Mariveles Baptist Church, Mariveles, Bataan

City of Makati, France in June

supports World Press Freedom Day, May 3

Register now and vote in midterm polls

supports International Nurses’ Day

Aspirants file your certificate of candidacy on October 1-8,2024

Substitute candidates must be with same surname and political party

Partylist must file Certificate of Nomination and Acceptance

supports May, Cardiac Illness Prevention Month

No to Divorce!!!

Get well soon Nanay Angelita Santiago-Lopez

PM for any hospital discharge problem

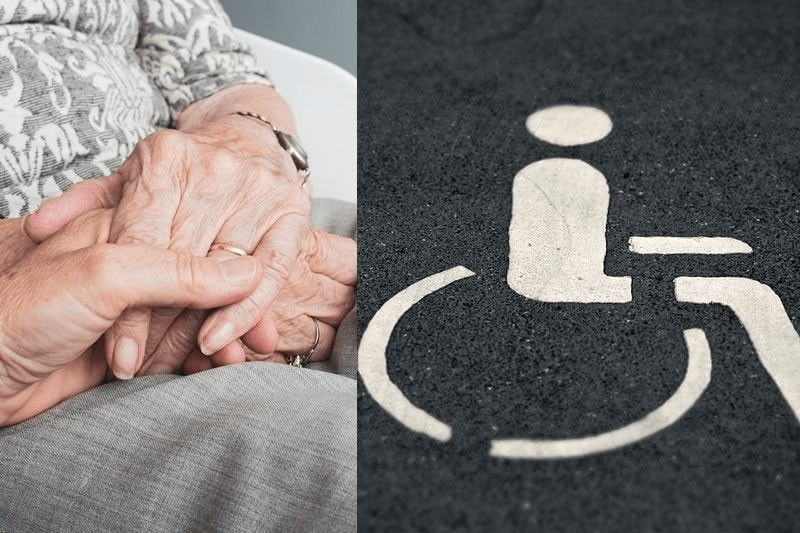

social pension bills enhanced

By Nidz Godino

“Twenty percent discount for senior citizens or PWDs applied on certain goods and services, input tax attributable to VAT-exempt sale to seniors and PWDs and special discount on basic necessities and prime commodities shall be treated as part of deductible expense pursuant to Section 34 of National Internal Revenue Code of 1997,” bill noted, three bills enhancing social pension for senior citizens and persons with disabilities (PWDs) were approved on third and final reading as administration and opposition lawmakers in House of Representatives crossed party lines.

Universal pension for seniors (House Bill 10423), enhanced discounts (HB 10312) and additional services in eGov PH Super App platform (HB 10313) have all been approved.

HB 10423 received overwhelming 232-0 affirmative votes. HB 10312 and HB 10313 both received 235-0 votes.

HB 10423 seeks to expand current social pension program to include all seniors, not just indigents.

Non-indigent seniors would receive P500 monthly stipend once measure is signed into law.

Within five years, all seniors would be entitled to universal social pension equivalent to monthly stipend of at least P1,000, regardless of any other pension benefits they may receive from other pension providers.

HB 10312 clarified existing discounts for seniors and PWDs should be treated as additional to “any prevailing promotional offers or discounts extended by business establishments.”

Proponents of measure House Majority Leader Manuel Jose Dalipe and Reps. Joey Salceda, Erwin Tulfo, Gus Tambunting, Luis Raymund Villafuerte and Rufus Rodriguez wanted 20 percent discount and exemption from value-added tax, as stated in the law, intact.

HB 10313 would include services for seniors and PWDs in eGov PH Super App.

Department of Information and Communications Technology is tasked with incorporating dedicated sections with “user-friendly interface including adjustable text sizes, voice assistance and other features.”